Relieve Your MCA

Stress in Days

Struggling with $50,000+ in MCA debt?

Increase monthly cash flow immediately

Protect your accounts receivable

Repay creditors affordably over time

Proudly woman-owned with over 20 years in the MCA industry, making us leaders in the space!

Note: We are unable to assist those with less than $50k in MCA debt.

Relieve Your MCA Stress in Days

Struggling with $50,000+ in MCA debt?

Proudly woman-owned with over 20 years in the MCA industry, making us leaders in the space!

Note: We are unable to assist those with less than $50k in MCA debt.

Relieve Your MCA Stress in Days

Struggling with $50,000+ in MCA debt?

Proudly woman-owned with over 20 years in the MCA industry, making us leaders in the space!

Note: We are unable to assist those with less than $50k in MCA debt.

Our Services

Debt Restructuring

We help clients restructure their debt in a smart and safe way. Our team reviews your current debt and works with lenders to change the payment terms.

Debt Settlement

We are experts in debt settlement. We speak directly with your creditors and work to reduce the total amount you owe

.

Debt Relief

We provide trusted debt relief solutions. Our team understands how stressful debt can be. We create a clear plan to reduce your debt

Negotiation

Our specialists handle all debt negotiations for you. We use proven methods to negotiate better terms with creditors.

Relief

We focus on giving our clients real financial relief. Our team takes control of the process and reduces the pressure from debt.

Consolidation

We offer professional debt consolidation services. Our experts combine your debts into one simple payment.

Real Client Testimonials

What Makes Regroup Partners The Smartest Choice?

DOJ Licensed

We are the only MCA Debt Relief firm licensed by the Department of Justice’s Office of Consumer Protection

20 Years of Expertise

Originally operating as Expedia Debt, we’ve been helping businesses since the MCA industry began in 2006.

Ethical & Compliant

Held to the highest standards with a consumer debt management license.

Tailored Solutions

Customized strategies to improve cash flow without disrupting your business operations.

Zero Hidden fees

Our fees are upfront from the beginning.

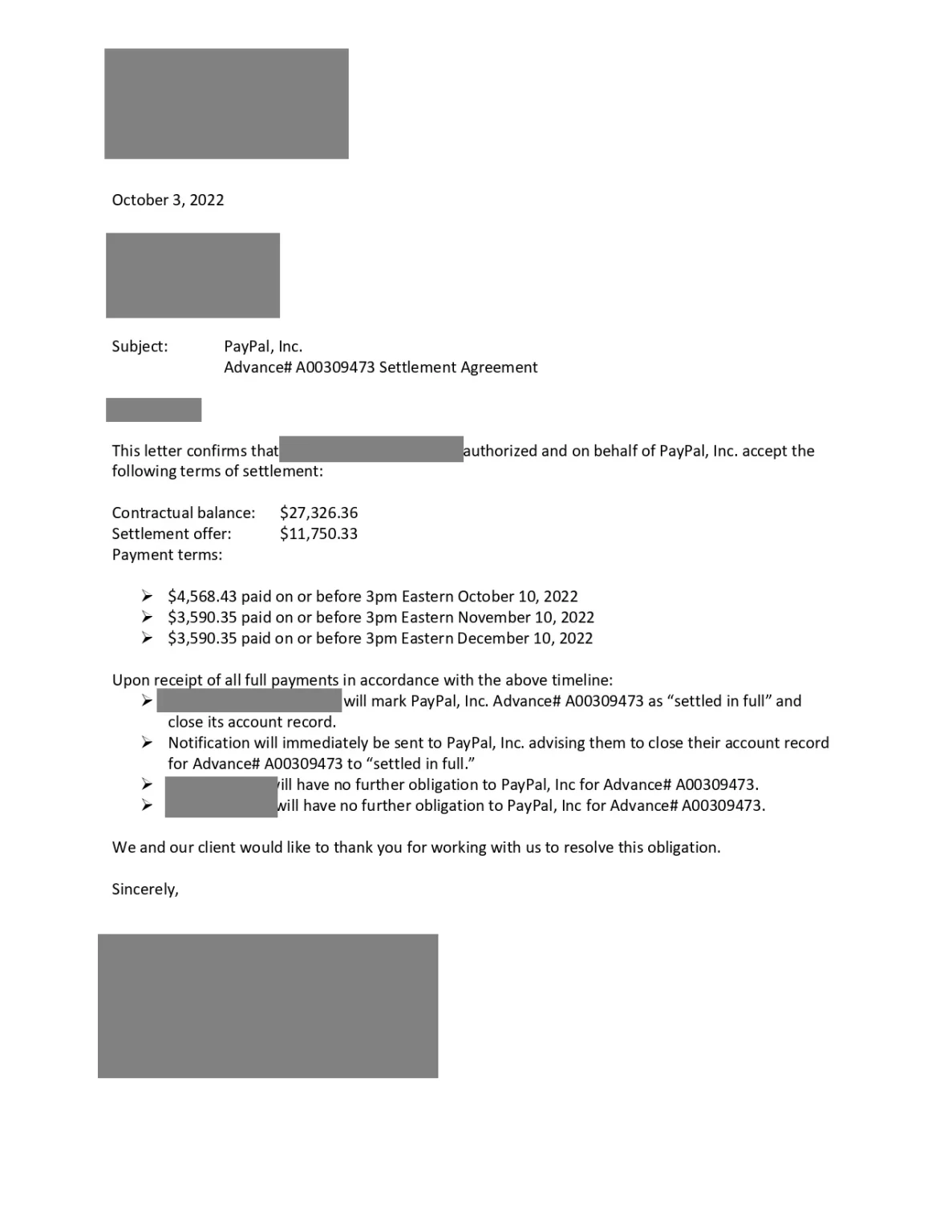

Real Results for Real Businesses

Contractual balance:

$27,326.36

Settlement offer:

$11,750.33

Outstanding Balance:

$22,000

Settlement offer:

$4,000

VMC purchased

$42,600.00

Purchase Price:

$30,000.00

Outstanding Balance:

$105,016

Settlement Offer:

$50,000

Here are some questions

to ask yourself

to determine if your business is in need of debt relief:

Is your cash flow restricted because of your current debt?

Have you taken advances to pay for other advances?

Are you in default/behind with payments or about to default?

Are your personal bills mounting as a result of not being able to take a salary?

Do you have over $50,000 in MCA (Merchant Cash Advance) business debt?

If you answered YES to any of these questions, our debt consolidation services are for you.

How We Can Help Your Business

We Reduce Your Business Debt & Get You Cashflow Relief.

IMMEDIATELY Increased your monthly cash flow.

Protect your accounts receivable.

Satisfy your creditors by paying what your business can afford.

Stretch the business debt payback over time and reduce it.

Get your business back on the right track financially.

Obtain peace of mind allowing you to focus on rebuilding.

Why Choose Regroup Partners?

Total Debt Paid Off

Millions

Businesses Helped

Thousands

Years of Experience

19+

Free Debt Counseling

Thousands of Businesses

What Our Clients Are Saying

Getting Out of MCA Debt is

as Easy as 1,2,3

Step 1

Your Free Confidential Consultation

Speak with a debt expert to evaluate

your situation—no obligation.

Step 2

Customized Debt Analysis

We’ll review your debts

and create a tailored plan.

Step 3

Negotiation & Settlement

Our team negotiates with creditors

to reduce your payments.

Call Today: (954) 280-2545

or click the link below to:

Regroup Partners vs. Competitors

Common Questions, Clear Answers

How do I know if I qualify for your program?

Answer: If your business has over $50,000 in MCA, vendor debt, or lines of credit, you likely qualify. Schedule a free consultation to confirm your eligibility and explore your options.

What types of debt do you handle?

Answer: We specialize in restructuring Merchant Cash Advances (MCA), vendor debt, and lines of credit over $50,000. We do not handle personal credit card debt, grants, SBA loans, car payments, or mortgages.

How much can I save with your program?

Answer: On average, our clients save 50-75% on their total debt. Savings depend on your unique financial situation and the types of debt you have.

Will this hurt my credit score?

Answer: No. Most MCA lenders do not report to credit bureaus, so working with us will not impact your personal credit score.

How long does the process take?

Answer: While some clients resolve their debt in 6 months, most achieve results within 12 months. We work at your pace to ensure minimal disruption to your business.

Is my information kept confidential?

Answer: Absolutely. We prioritize your privacy and ensure all information shared with us is kept strictly confidential.

Ready to Take the First Step Toward Financial Freedom?

Don’t let debt control your business. Schedule your free consultation today

and see how much you can save

Call Today: (954) 280-2545

or click the link below to:

Regroup Partner provide business distress solutions to businesses of all sizes that aid in the mission to ultimately ensure peace of mind to business owners in a time of need.

Office Information

5255 North Federal Highway Suite 301 Boca Raton 33487

(954) 228-8325

Email Us

Join Newsletter

Disclaimer: Regroup Partners does not provide services related to consumer debt or credit counseling. Our program may not be available in all states. We encourage you to read and understand all program materials before accepting our services. Please note that we do not charge upfront fees. We negotiate restructuring terms and agreements directly with creditors/lenders in conjunction with our clients. Regroup Partners is committed to diligently working towards the reduction of all business debts exclusively. Regroup Partners is not a licensed law firm. Regroup Partners co is licensed registered with the department of justice office of consumer protection consumer management. In accordance with the debt management service act (MCA 30-14, Part 20).

Copyright 2026. Regroup Partners. All Rights Reserved.